Pick a pool. Click the menu icon at the very best still left of the website. Pick which pool you want to to offer liquidity much too.

Delivering liquidity into a Curve pool can get paid you trading expenses and benefits. Decide on a pool and deposit your tokens to start out earning.

BitDegree.org will not endorse or suggest you to buy, offer or hold virtually any copyright. Prior to making economical investment selections, do talk to your money advisor.

We update our knowledge frequently, but facts can change in between updates. Ensure details Together with the company you might be considering before you make a decision.

The like-asset method for AMMs is not only relevant to stablecoins. wBTC and renBTC, two tokenized variants of bitcoin (BTC), are also included in Curve’s liquidity pools. Bitcoin may be very unstable in comparison with stablecoins, though the Curve method even now functions considering that tokens in Curve pools should be stable to other tokens in the identical pool.

Vote: Take part in selections influencing the System, for example cost structures and pool incentives. Get paid Benefits: Liquidity vendors make CRV tokens, that may be curve fi staked for additional Advantages.

In brief, impermanent reduction is often a reduction in dollar worth that liquidity companies can endure whilst providing liquidity to an AMM.

By concentrating on stablecoins, Curve provides a lending protocol that is fewer unstable than other platforms, although nonetheless providing high fascination about the liquidity supplied.

On account of this, even enormous sizes working experience amazingly lower slippage. Curve’s spread can proficiently compete with a number of the greatest-liquid OTC desks and centralized exchanges.

AMM Algorithms, which can be used to effectively selling price tokens inside the liquidity pool In accordance with numerous conditions, including the purchase and offer pressures exerted by traders.

) mechanics. Especially, it's possible you'll make a passive cash flow by staking your property on one of several Curve liquidity pools. What's the CRV token? The CRV token may be the native copyright on the Curve Finance ecosystem. When it's a couple of various use scenarios

You should take into account impermanent reduction, similar to with any other AMM protocol, ahead of introducing liquidity to Curve.

A appropriate to withdraw DAI from Compound with fascination is conferred on holders of cDAI. With the chance to deploy cDAI in Curve’s liquidity pools, individuals might get a next layer of utility and likely benefit from a specified expenditure.

No matter whether you’re a trader in search of lower slippage swaps or even a liquidity provider aiming to gain passive revenue, Curve Finance presents a strong System for the DeFi desires.

Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Gia Lopez Then & Now!

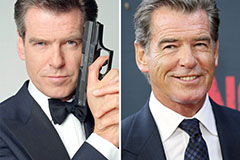

Gia Lopez Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!